Bill to expand SEED scholarship to students with violent felonies stalls in Delaware House Committee

DOVER — An attempt to allow the last remaining group of Delawareans barred from utilizing the Student Excellence Equals Degree (SEED) Program for higher education was nixed during …

-

-

Despite opposition, paid sick time and safety leave bill passes Delaware House committee

DOVER— Republican lawmakers opposed a bill requiring Delaware employers to offer earned sick time and safety leave, though it received enough …

-

-

-

Sussex County Council reverses previous zoning denial

In August 2023, County Council voted 3-2 to deny a conditional use application for a solar farm south of Frankford but reversed course Tuesday …

-

-

-

Homeless Bill of Rights pulled from Delaware House committee's Wednesday agenda

DOVER — As lawmakers prepared to return from their two-week spring recess on Monday, the Bill of Rights for Individuals Experiencing …

-

-

MILFORD – The Food Bank of Delaware is ready to spring into action. On April 30 from 10 a.m. to 12 p.m. the Food Bank of Delaware Milford branch will hold their spring senior health fair. …

View this issue of The Delaware State News or browse other issues.

Disclosure

-

-

Witham: Are vets’ health benefits being used for illegal immigrants?

Veteran benefits, including health care, are not just a nice perk for veterans. They are something earned through the service, and often …

-

-

-

QOTW: How do you feel the housing situation stands in Delaware?

We’ve been reporting on housing data in the First State and whether there are enough affordable residences for citizens of every financial …

-

-

-

Rothstein: We want your Opinion for the Greater Dover Independent

I am Benjamin Rothstein, and you have probably seen my name pop up all over the Greater Dover Independent.

-

-

Social Security Administration office returns to Georgetown

GEORGETOWN — The Social Security Administration returned to Georgetown on April 15 after several years of operating in Lewes. Social Security Administration has relocated to 17 …

Delaware ends spring football with everybody happy

‘A true miracle’: Dover’s Buttillo returns to lacrosse field after accident

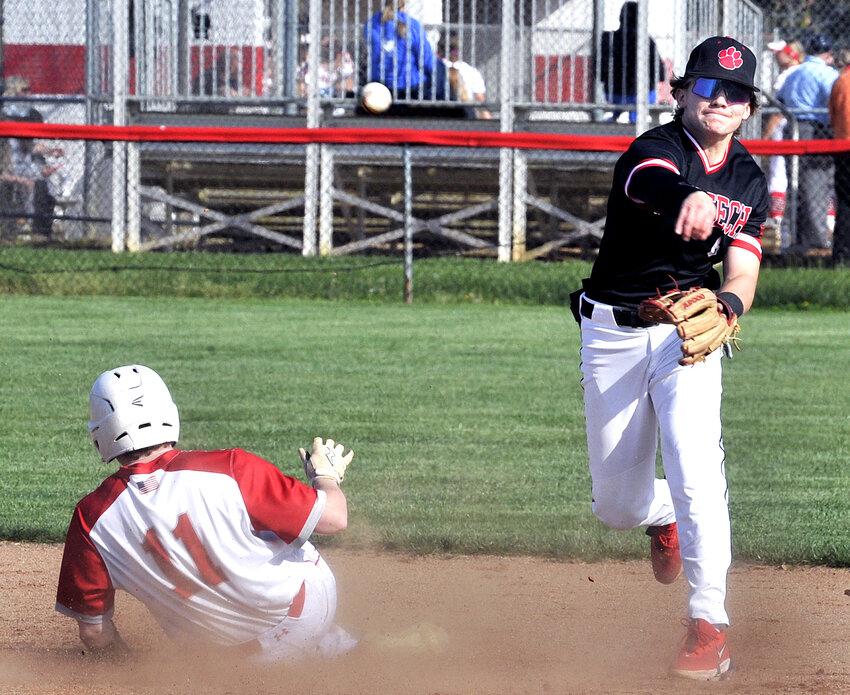

Photo gallery: Polytech vs. Smyrna baseball

Thursday's Downstate Delaware high school scores

College notes: Delaware State basketball team loses another standout but adds three transfers

More Sports