From blight to bright, redevelopment in Seaford's future

A Thursday groundbreaking was a time to reflect on decades back, when the Nylon Capital Shopping Center in Seaford was a regional retail hub. But there was also hope for the future, with a planned revitalization of the 22-acre site that has been mostly dormant for many years on the city’s western edge.

-

-

New Dover football coach wants to hit the ground running

DOVER — Maurice Paulk knows that the start of next football season is only about four months away. He also knows that Dover High’s …

-

-

-

Delaware officials underscore urgency regarding drug use

Lt. Gov. Bethany Hall-Long and leaders from the Department of Health and Social Services, along with partner agencies, led a briefing Monday to …

-

-

-

Townsend officer earns top Delaware Crime Stoppers award

TOWNSEND — He served as an Delaware Assistant Deputy Attorney General prosecuting child support cases.

-

-

The Sussex County Planning & Zoning Commission voted Wednesday to advance an ordinance governing marijuana establishments to County Council, which will soon hold a public hearing on the matter.

View this issue of The Delaware State News or browse other issues.

Disclosure

-

-

Sipple: Would restricting sale of ammo decrease gun violence?

I respect the opinion of Dover City Councilman Brian E. Lewis about needing solutions for Dover’s recent shootings (“Solutions needed after …

-

-

-

Hazzard: Another supporter of Delaware Photographers’ Project

I strongly agree with Dan Shortridge’s encouraging a photo history of Delaware (“We need a Delaware Photographers’ Project”).

-

-

-

Brady: The challenges and solutions for Delaware's labor drought

We are all aware of the ridiculous amounts of money that the federal government was offering states during the pandemic. Many of those states, …

-

-

Milford Museum to present program on desegregation in New Castle

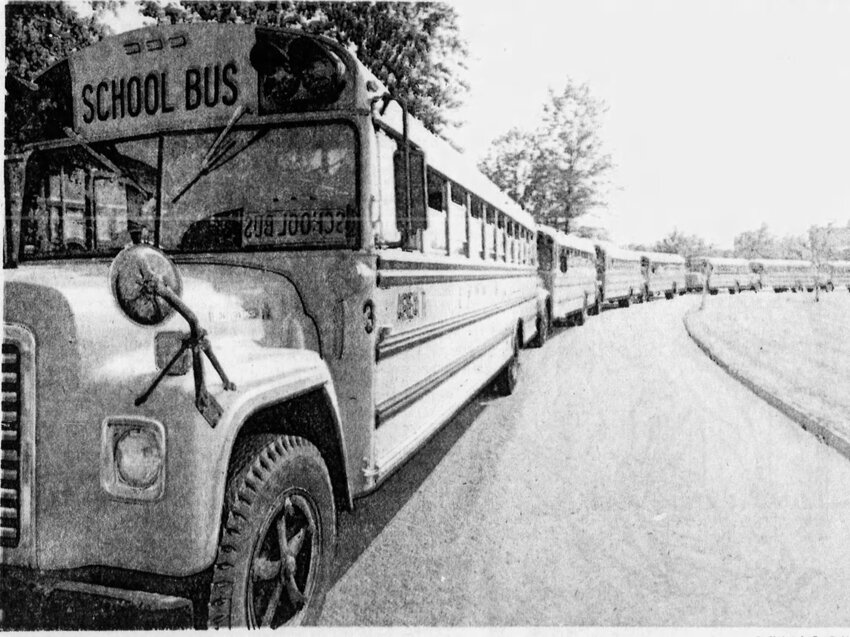

MILFORD -- The Milford Museum will continue its American History Series with a program titled “To Bus or Not to Bus: The 1977 School Desegregation of New Castle County, Delaware” at the …

Photo gallery: Smyrna vs. Lake Forest softball

Polytech softball seniors are proud of the improvement they've made

Downstate Delaware high school scores

Rosters named for Blue-Gold all-star football game

DIAA takes next step in allowing student-athletes to be paid

More Sports