Delaware House lawmakers combine efforts on bipartisan school meal bill

DOVER — House lawmakers are consolidating their efforts in a bipartisan attempt to increase access to school meals for low-income students in the First State. In April 2023, Rep. Rae …

-

-

Homeless Bill of Rights pulled from Delaware House committee's Wednesday agenda

DOVER — As lawmakers prepared to return from their two-week spring recess on Monday, the Bill of Rights for Individuals Experiencing …

-

-

-

Delaware's June Jam CEO, founder Hartley dead at 68

Bob Hartley, CEO and president of the June Jam charity music festival, died in his sleep Sunday.

-

-

-

Sussex County Council reverses previous zoning denial

In August 2023, County Council voted 3-2 to deny a conditional use application for a solar farm south of Frankford but reversed course Tuesday …

-

-

The Milford School District is amid a strategic development plan, including the rebuild of a school that has been shuttered since 2013.

View this issue of The Delaware State News or browse other issues.

Disclosure

-

-

QOTW: How do you feel the housing situation stands in Delaware?

We’ve been reporting on housing data in the First State and whether there are enough affordable residences for citizens of every financial …

-

-

-

Rothstein: We want your Opinion for the Greater Dover Independent

I am Benjamin Rothstein, and you have probably seen my name pop up all over the Greater Dover Independent.

-

-

-

Lewis: Solutions needed after rash of shootings in Dover

As one of your Dover City Council members and chair of the Safety Advisory and Transportation Committee, I felt compelled to publicly express …

-

-

Social Security Administration office returns to Georgetown

GEORGETOWN — The Social Security Administration returned to Georgetown on April 15 after several years of operating in Lewes. Social Security Administration has relocated to 17 …

‘A true miracle’: Dover’s Buttillo returns to lacrosse field after accident

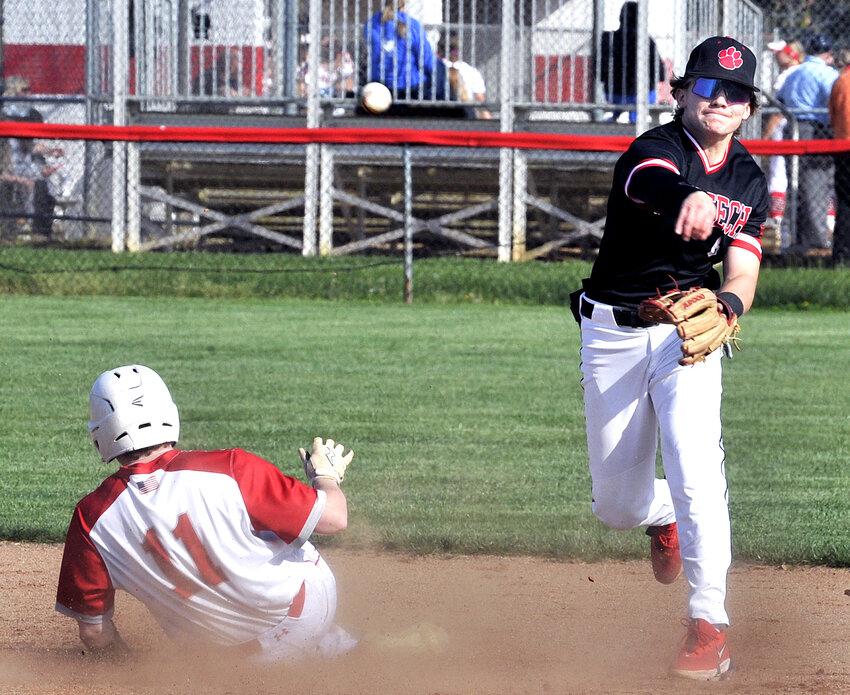

Photo gallery: Polytech vs. Smyrna baseball

Thursday's Downstate Delaware high school scores

College notes: Delaware State basketball team loses another standout but adds three transfers

Downstate Delaware high school scores

More Sports