New Smyrna facility offers weight loss, behavioral treatment

Dr. Eugenia Caternor operates a pair of Smyrna businesses that could treat one patient in two different ways — as a visit to the Kairos Embrace Behavioral Health Clinic can be a trip to Transformations Center for Weight Loss, too.

-

-

Delaware Division of Small Business, Small Business Development Center partner to support business owners seeking loans

DOVER — The Delaware Division of Small Business is partnering with the Delaware Small Business Development Center to provide additional …

-

-

-

Dover mayor, council people denounce violence in Dover

DOVER -- Monday's Dover City Council meeting concluded with a passionate message from Mayor Robin R. Christiansen regarding recent violent …

-

-

-

Downstate Delaware high school scores

BASEBALL Milford 2, First State Military 1 Seaford 3, Delmarva Christian 0 Saint Mark’s 7, Smyrna 1 Dover 15, Hodgson 1 Milford 4, Delmarva …

-

-

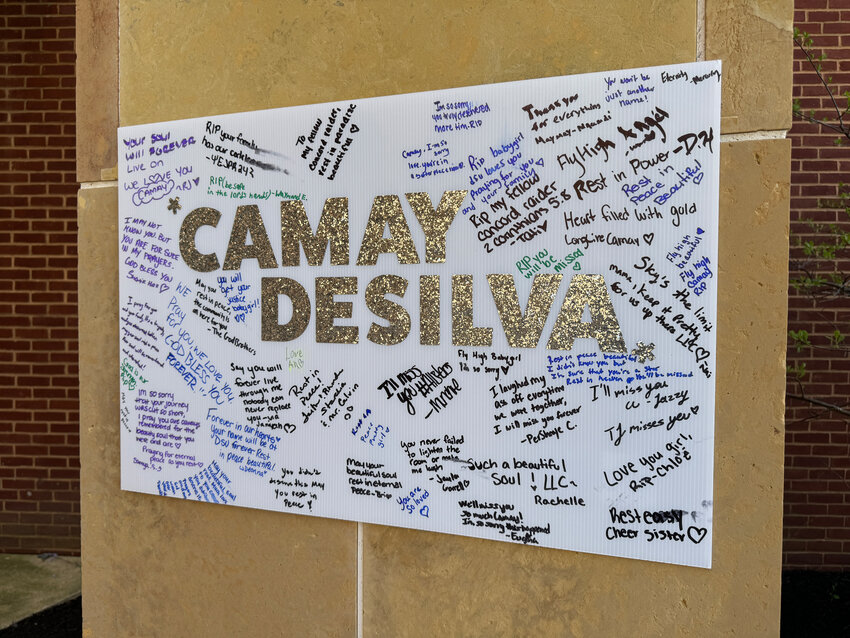

In the wake of Sunday’s deadly shooting at Delaware State University in Dover, which took the life of 18-year-old Camay DeSilva of Wilmington, school officials hosted a student forum Tuesday to speak about worry among community members.

View this issue of The Delaware State News or browse other issues.

Disclosure

-

-

Cisse: An opportunity to mark significance of IP rights

The World Intellectual Property Organization has declared Friday as World Intellectual Property Day, an occasion for all of us to take a moment …

-

-

-

Speak Up: How will cannabis commerce change Delaware?

Marijuana businesses are on their way to the First State, after the substance’s legalization for recreational use last year. What are your …

-

-

-

Speak Up: Gubernatorial candidate Meyer unveils plan to improve education

New Castle County Executive and gubernatorial candidate Matt Meyer has unveiled a comprehensive, 23-page education plan that focuses on remedies …

-

-

M&D Bird Farm flies high in Harbeson

HARBESON — There are things one might expect when driving the roads of Sussex County. Construction is likely. Traffic might be a definite, depending on where you are. But it’s not common …

Jones sidelined from Dover race with back injury from Talladega

Photo gallery: Sussex Central vs. Cape Henlopen baseball

Trainer Ness aiming to break Delaware Park record

Downstate Delaware high school scores

Majorca N posts first win at Harrington Raceway

More Sports