Townsend officer earns top Delaware Crime Stoppers award

TOWNSEND — He served as an Delaware Assistant Deputy Attorney General prosecuting child support cases.

-

-

Delaware officials underscore urgency regarding drug use

Lt. Gov. Bethany Hall-Long and leaders from the Department of Health and Social Services, along with partner agencies, led a briefing Monday to …

-

-

-

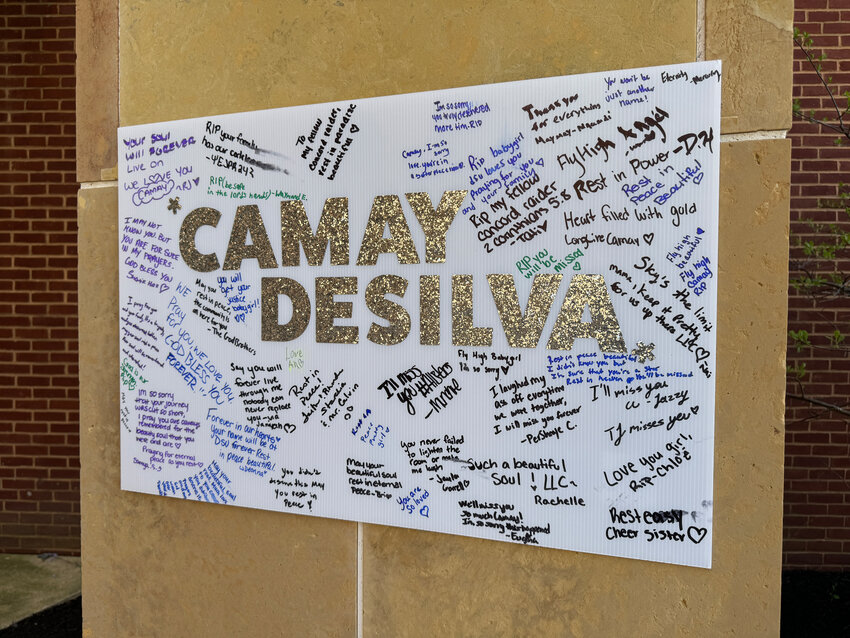

Delaware State University addresses concerns after deadly shooting

In the wake of Sunday’s deadly shooting at Delaware State University in Dover, which took the life of 18-year-old Camay DeSilva of Wilmington, …

-

-

-

Downstate Delaware high school scores

BASEBALL Dover 14, Smyrna 2 Polytech 11, Milford 1 Delmar 9, Seaford 1 Indian River 10 , Lake Forest 0 Laurel 3, Woodbridge 0 Saint Mark’s 3, …

-

-

GEORGETOWN — A listing on the online job board Indeed has appeared soliciting candidates for a Director of Planning and Zoning in the county, while Jamie Whitehouse, hired to the position in …

View this issue of The Delaware State News or browse other issues.

Disclosure

-

-

Rothenberg: Website offers key info about school board elections

School board elections are grassroots democracy at its best. In Delaware, you don’t even need to be registered to vote to cast your ballot; …

-

-

-

Smith: How can we gain support for an inspector general?

Our organization, the Delaware Coalition for Open Government, took years to come to this point, appearing both in person and virtually. We have …

-

-

-

Cisse: An opportunity to mark significance of IP rights

The World Intellectual Property Organization has declared Friday as World Intellectual Property Day, an occasion for all of us to take a moment …

-

-

County renews firework shops contract in Rehoboth, Seaford

GEORGETOWN — Keystone Distributors, which since at least 2021 has operated the pop-up firework shops that appear in the Tanger Outlets, 36461 Seaside Outlet Drive in Rehoboth Beach, and …

New Dover football coach wants to hit the ground running

Harrington Raceway harness racing results

Photo gallery: Sussex Central vs. Cape Henlopen baseball

Trainer Ness aiming to break Delaware Park record

Downstate Delaware high school scores

More Sports