Bill to provide Medicaid coverage for pregnancy termination advances as Delaware General Assembly returns from break

DOVER — The General Assembly returned to the state capitol on Tuesday after a two-week spring recess, but missed no time getting back to work. With just over two months left of this …

-

-

Homeless Bill of Rights pulled from Delaware House committee's Wednesday agenda

DOVER — As lawmakers prepared to return from their two-week spring recess on Monday, the Bill of Rights for Individuals Experiencing …

-

-

-

Delaware's June Jam CEO, founder Hartley dead at 68

Bob Hartley, CEO and president of the June Jam charity music festival, died in his sleep Sunday.

-

-

-

Sussex County Council reverses previous zoning denial

In August 2023, County Council voted 3-2 to deny a conditional use application for a solar farm south of Frankford but reversed course Tuesday …

-

-

DOVER — This is the time of the year when Miles the Monster’s heart starts to beat a little louder and his pulse begins to race. While the NASCAR Cup Series competes at Talladega …

View this issue of The Delaware State News or browse other issues.

Disclosure

-

-

Lewis: Solutions needed after rash of shootings in Dover

As one of your Dover City Council members and chair of the Safety Advisory and Transportation Committee, I felt compelled to publicly express …

-

-

-

Goduti: Kennedy left vision for peace unfinished

Less than a week after her husband’s assassination in Dallas on Nov. 22, 1963, Jackie Kennedy granted an interview with esteemed political …

-

-

-

Moreno and Radesky: Online child safety laws could help or hurt

Society has a complicated relationship with adolescents. We want to protect them as children and yet launch them into adulthood. Adolescents …

-

-

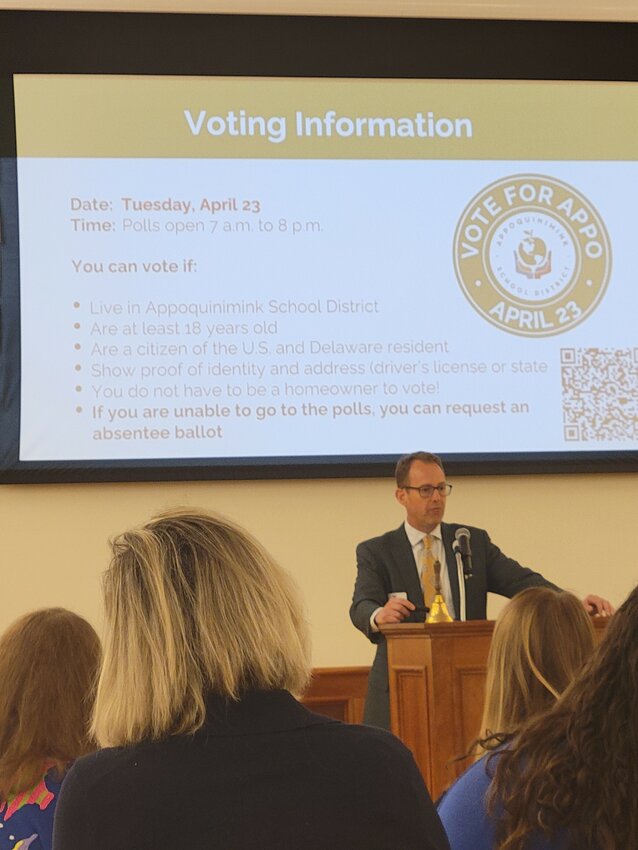

Middletown Area Chamber of Commerce holds spring luncheon

The Middletown Area Chamber of Commerce Spring Luncheon was held Wednesday at Middletown Memorial Hall.

Thursday's Downstate Delaware high school scores

College notes: Delaware State basketball team loses another standout but adds three transfers

Downstate Delaware high school scores

Harrington Raceway harness racing results

Photo gallery: Cape Henlopen vs. Caesar Rodney boys' lacrosse

More Sports