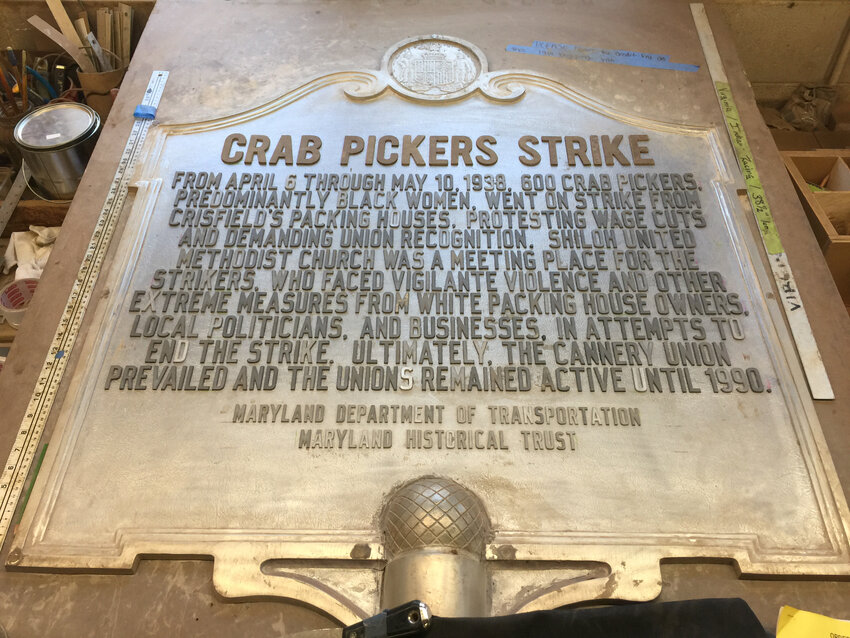

Crab pickers strike of 1938 will be remembered with new historic marker in Crisfield

CRISFIELD — A third official state historical marker along the dual highway here will be dedicated this week to recall a transformational crab pickers strike that took place 86 years ago. …

-

-

Delaware’s only asphalt terminal under new ownership

Russell Standard, a Pittsburgh-based asphalt materials and pavement preservation company, has assumed operations of the state’s only asphalt …

-

-

-

SoDel restaurant part of plans for Dupont Boulevard in Millsboro

The developer of a 3-acre property on northbound Dupont Boulevard in Millsboro received preliminary site plan approval from Town Council on …

-

-

-

Dover Police announce arrests in deadly shooting at Delaware State University

Dover Police on Monday announced two arrests in connection with the fatal shooting of an 18-year-old Wilmington woman at Delaware State …

-

-

DOVER — As the highly-debated bill to implement a Delaware hospital cost review board was considered by the Senate Executive Committee on Tuesday, Senate Majority Leader Bryan Townsend …

View this issue of The Delaware State News or browse other issues.

Disclosure

-

-

Sipple: Would restricting sale of ammo decrease gun violence?

I respect the opinion of Dover City Councilman Brian E. Lewis about needing solutions for Dover’s recent shootings (“Solutions needed after …

-

-

-

Hazzard: Another supporter of Delaware Photographers’ Project

I strongly agree with Dan Shortridge’s encouraging a photo history of Delaware (“We need a Delaware Photographers’ Project”).

-

-

-

Brady: The challenges and solutions for Delaware's labor drought

We are all aware of the ridiculous amounts of money that the federal government was offering states during the pandemic. Many of those states, …

-

-

Marijuana ordinance clears Sussex Planning & Zoning

The Sussex County Planning & Zoning Commission voted Wednesday to advance an ordinance governing marijuana establishments to County Council, which will soon hold a public hearing on the matter.

Esports are becoming part of Delaware’s schools

Twin Delight a winner at Harrington Raceway

Sprocket makes it three in a row at Harrington Raceway

Athlete of the Week: Anthony Hatch, Caesar Rodney baseball

Caesar Rodney girls' tennis team driven by chance to net second straight state title

More Sports