Georgetown Little League confronts homelessness, drug use issues

Homelessness and apparent drug use continue to hit home at the Georgetown Little League facility, stirring safety concerns and precautions after needles and human feces were discovered on the property.

-

-

Delaware Division of Small Business, Small Business Development Center partner to support business owners seeking loans

DOVER — The Delaware Division of Small Business is partnering with the Delaware Small Business Development Center to provide additional …

-

-

-

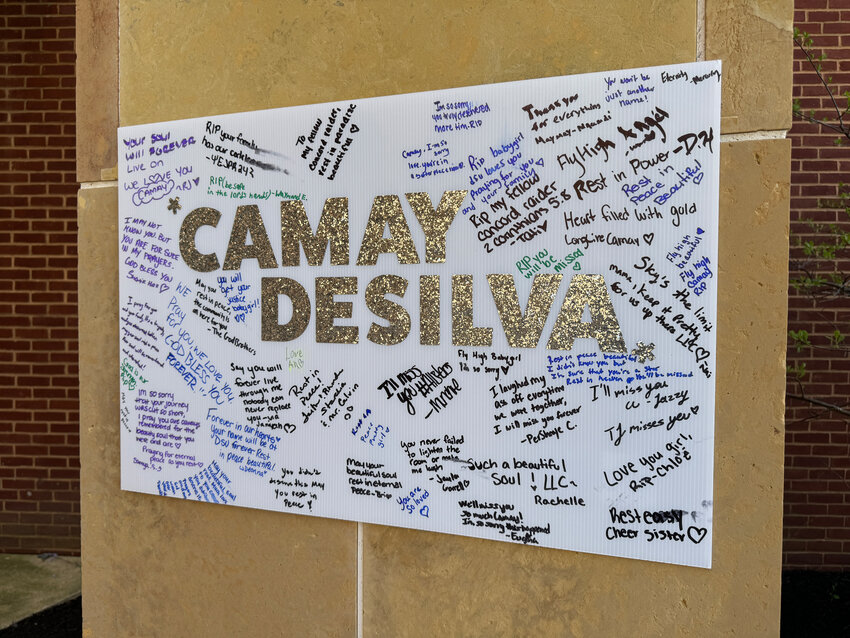

Dover mayor, council people denounce violence in Dover

DOVER -- Monday's Dover City Council meeting concluded with a passionate message from Mayor Robin R. Christiansen regarding recent violent …

-

-

-

Downstate Delaware high school scores

BASEBALL Milford 2, First State Military 1 Seaford 3, Delmarva Christian 0 Saint Mark’s 7, Smyrna 1 Dover 15, Hodgson 1 Milford 4, Delmarva …

-

-

Dr. Eugenia Caternor operates a pair of Smyrna businesses that could treat one patient in two different ways — as a visit to the Kairos Embrace Behavioral Health Clinic can be a trip to Transformations Center for Weight Loss, too.

View this issue of The Delaware State News or browse other issues.

Disclosure

-

-

Smith: How can we gain support for an inspector general?

Our organization, the Delaware Coalition for Open Government, took years to come to this point, appearing both in person and virtually. We have …

-

-

-

Cisse: An opportunity to mark significance of IP rights

The World Intellectual Property Organization has declared Friday as World Intellectual Property Day, an occasion for all of us to take a moment …

-

-

-

Speak Up: How will cannabis commerce change Delaware?

Marijuana businesses are on their way to the First State, after the substance’s legalization for recreational use last year. What are your …

-

-

M&D Bird Farm flies high in Harbeson

HARBESON — There are things one might expect when driving the roads of Sussex County. Construction is likely. Traffic might be a definite, depending on where you are. But it’s not common …

Jones sidelined from Dover race with back injury from Talladega

Photo gallery: Sussex Central vs. Cape Henlopen baseball

Trainer Ness aiming to break Delaware Park record

Downstate Delaware high school scores

Majorca N posts first win at Harrington Raceway

More Sports