Air quality report gives Delaware mixed reviews

Delawareans can control their collective fate to some degree when it comes to air pollution. While the state fared well in the 2024 “State of the Air” report recently released by the American Lung Association, improvements can be made.

-

-

Delaware officials underscore urgency regarding drug use

Lt. Gov. Bethany Hall-Long and leaders from the Department of Health and Social Services, along with partner agencies, led a briefing Monday to …

-

-

-

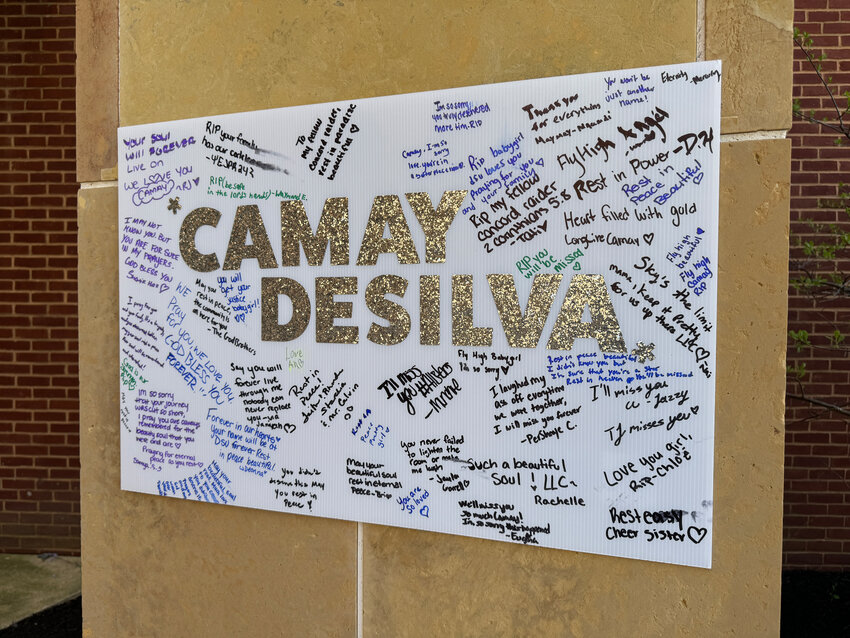

Delaware State University addresses concerns after deadly shooting

In the wake of Sunday’s deadly shooting at Delaware State University in Dover, which took the life of 18-year-old Camay DeSilva of Wilmington, …

-

-

-

Delaware Division of Small Business, Small Business Development Center partner to support business owners seeking loans

DOVER — The Delaware Division of Small Business is partnering with the Delaware Small Business Development Center to provide additional …

-

-

TOWNSEND — He served as an Delaware Assistant Deputy Attorney General prosecuting child support cases.

View this issue of The Delaware State News or browse other issues.

Disclosure

-

-

Mason: There’s a lack of confidence in Dover’s leaders

After reading about the string of headline-making violence in Dover within the last month, I think it’s time for a change in our city …

-

-

-

Speak Up: How do you feel the housing situation stands in Delaware?

We’ve been reporting on housing data in the First State and whether there are enough affordable residences for citizens of every financial …

-

-

-

Rothenberg: Website offers key info about school board elections

School board elections are grassroots democracy at its best. In Delaware, you don’t even need to be registered to vote to cast your ballot; …

-

-

County renews firework shops contract in Rehoboth, Seaford

GEORGETOWN — Keystone Distributors, which since at least 2021 has operated the pop-up firework shops that appear in the Tanger Outlets, 36461 Seaside Outlet Drive in Rehoboth Beach, and …

Rosters named for Blue-Gold all-star football game

DIAA takes next step in allowing student-athletes to be paid

Photo gallery: Caesar Rodney vs. Smyrna, boys' lacrosse

New Dover football coach wants to hit the ground running

Harrington Raceway harness racing results

More Sports