Dover mayor, council people denounce violence in Dover

DOVER -- Monday's Dover City Council meeting concluded with a passionate message from Mayor Robin R. Christiansen regarding recent violent events in Dover. "Let them get the message that …

-

-

Spring game gives Delaware State's Adams chance to show that he's improving

DOVER — Marqui Adams says he could definitely get used to throwing to Kristian Tate. Twice during Delaware State’s Red-White spring …

-

-

-

Brady: Government running business a bad idea

Delaware’s government clearly does not run like a business. It never has. But some in our state’s government think they can run a business …

-

-

-

Photo Gallery: Delaware Defense Day

LEWES – Delaware Defense Day, a living history event that celebrates the World War II victory over Nazi Germany, brought WWII reenactors, …

-

-

DOVER — Nearly a year after Delaware’s Department of Justice announced the theft of over 500,000 rounds of ammunition at the Christiana Cabela’s, state lawmakers are working to set …

View this issue of The Delaware State News or browse other issues.

Disclosure

-

-

Speak Up: How will cannabis commerce change Delaware?

Marijuana businesses are on their way to the First State, after the substance’s legalization for recreational use last year. What are your …

-

-

-

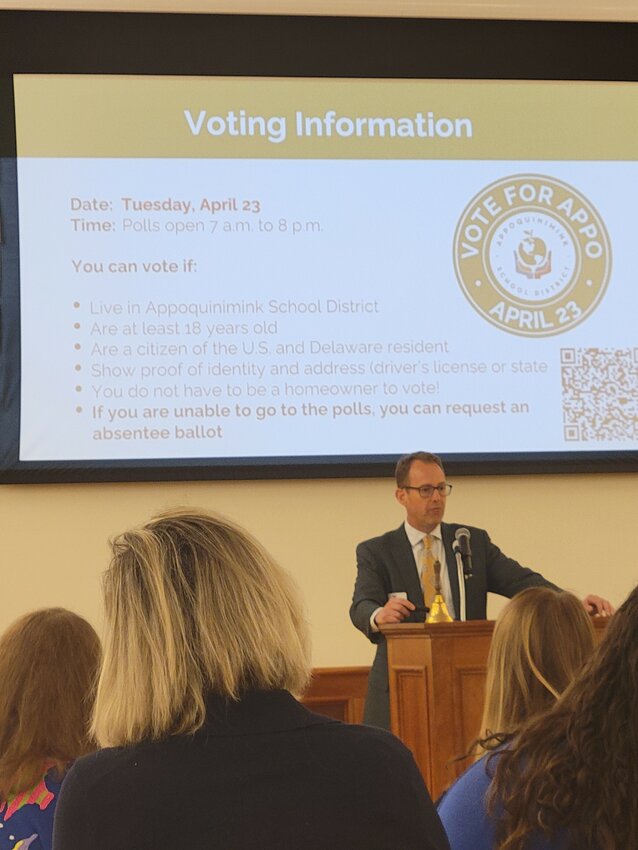

Speak Up: Gubernatorial candidate Meyer unveils plan to improve education

New Castle County Executive and gubernatorial candidate Matt Meyer has unveiled a comprehensive, 23-page education plan that focuses on remedies …

-

-

-

Speak Up: Delaware’s June Jam CEO, founder Hartley dead at 68

Bob Hartley, CEO and president of the June Jam charity music festival, died in his sleep April 14. Lynn Fowler, executive vice president of the …

-

-

M&D Bird Farm flies high in Harbeson

HARBESON — There are things one might expect when driving the roads of Sussex County. Construction is likely. Traffic might be a definite, depending on where you are. But it’s not common …

Smyrna boys' lacrosse team set to put its 8-0 record to the test

College notes: Delaware State baseball enjoying win streak; Delaware adds basketball transfer

Downstate Delaware high school scores

Harrington Raceway harness racing results/entries

Photo Gallery: Felton Little League opening day

More Sports